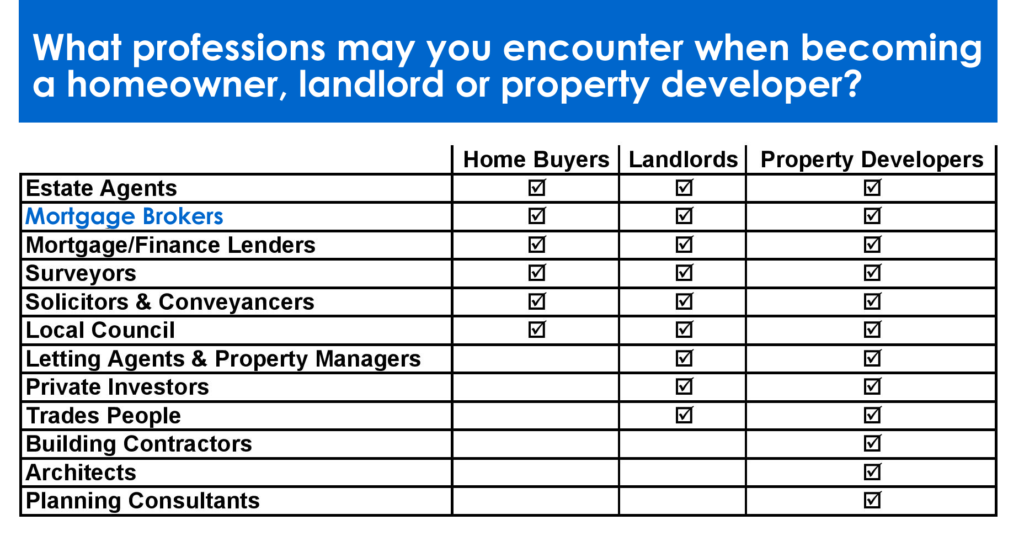

Picking a mortgage broker is actually a really important part of your property investment journey, yet it’s something that’s often decided very quickly without much thought. This short video will explain how to find the best mortgage broker for the right situation and help you to avoid losing money on mortgage valuation and broker fees.